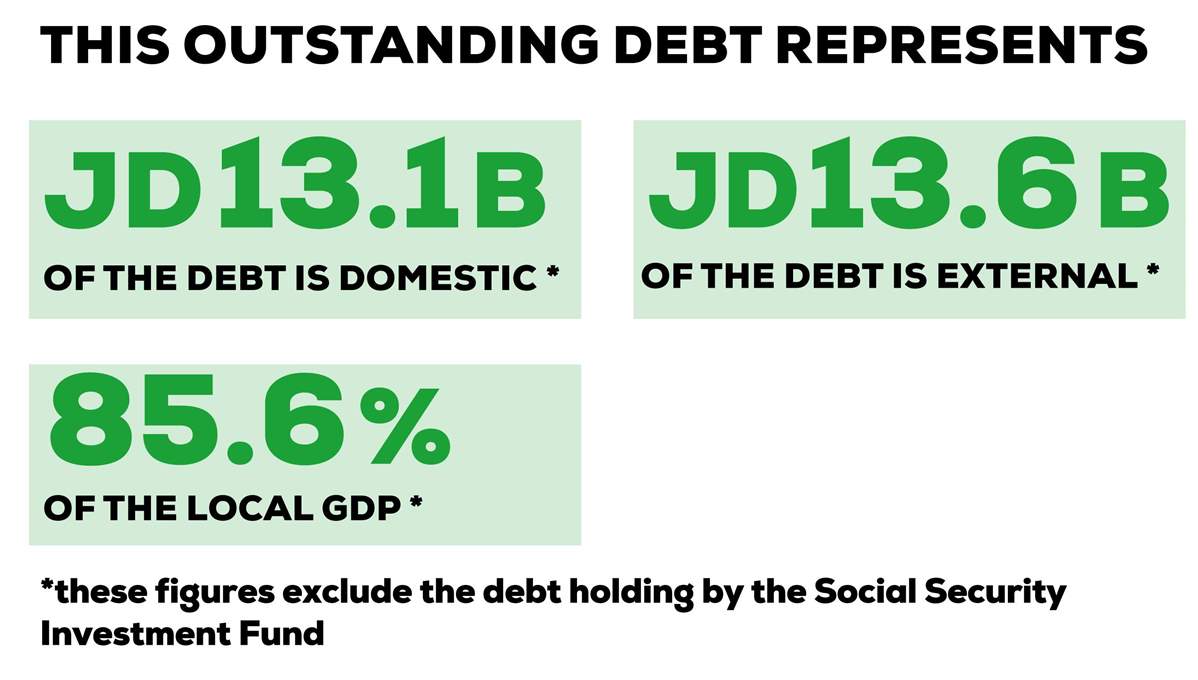

AMMAN — Jordan’s public debt recorded a 0.9 percent increase to reach JD33.3 billion in February 2021 (or JD26.7 billion excluding the debt held by the Social Security Investment Fund), according to a Ministry of Finance bulletin.

اضافة اعلان

“This is expected because

COVID has been difficult on the economy,” said associate professor of accounting at

Princess Sumaya University Radhi Hamadeen in a phone interview with Jordan News. “There was a decline in many industries, namely the service industry including tourism and restaurant sectors.” This resulted in a drop in government revenue.

The resultant fall in economic activity paired with the rise in unemployment interrupted a cycle consisting of consumption, savings, and investments in Jordan, and slowed overall activity, said the professor.

Hamadeen believes that the government needs to find creative solutions to strengthen the economy and reduce “widespread pessimism”. “We need to create a stronger business environment in Jordan to encourage local and foreign investments,” he said.

As economist

Salameh Darawi explained in a TV interview, the country’s debt index is one of the main measures taken into account when considering investments in Jordan.

“The current debt situation has reached an unsafe level,” Salameh said. “This is related to two main points, the first is the developments in the budget deficit and the second is the overall performance of public finances,” he added.

Salameh believes that the increase in this debt represents a failure of the public sector in managing the national economy due to the absence of a solid national strategy to deal with debt.

“This situation of high indebtment is normal for Jordan and is unlikely to change,” said member of the Global Challenges Forum board of directors Riad Al-Khouri. “Jordan has gone through phases of very high indebtment or high indebtment,” he said. “In all cases, Jordan is indebted.”

According to Khouri, the pandemic has added to the burden, but debt and unemployment indicators were all rising even before the pandemic. This he believes, is a direct result of the combination of high consumption and low production in Jordan.

“If you can raise your production while controlling your consumption then you are — if not solving the debt problem — not making it worse,” Khouri told Jordan News.

Among the biggest government expenditures, he said, are salaries, pensions, and debt servicing. “The Jordanian government today is not really spending most of its money on social care: on building roads or on setting up new facilities. They are just in fact financing consumption and debt.”

Read more Business stories.

Read more Business stories.