This week, the US Securities & Exchange

Commission launched a probe into the digital engagement practices that are used

by brokerage firms. Such practices include the digital advertising,

communications, and user interactions with the brokerage's systems. This probe

also took into account the new phenomena of the gamification of stock trading.

Stock trading and investing in financial markets has

always utilized highly technical and incredibly practical systems. Platforms

like Bloomberg terminal, CapIQ, and others have always had an industrial feel

and look to them with almost no focus on user interface design and user friendliness.

Bankers, traders, and investment advisors also acquired reports in the form of

huge financial statements and large data sets which they would granulate and

organize using tools like MS Excel and SQL. Imagine a stereotypical trading floor with people sitting in front of a handful of screens with colored

keyboards and strange-looking charts laid out before them; this was the reality

of the trading world.

Today, however, with the growth and popularity of

smartphones and newly emerging sciences such as user experience optimization,

systems are being designed around the user and how apps look and feel is highly

relevant to their layout. You may notice applications are growing more and more

similar in their look and feel, especially in their user experience.

Trading applications like Etoro, RobinHood, and IQ

Options are probably the ones you hear of most often — it’s very likely you’ve

come across them through a Facebook or YouTube advertisement. These apps were

built for one purpose: To disrupt the digital trading world through gamifying

the user experience by adding colors and

unique designs to each stock and providing notifications and alerts in a way

people are used to with their social media.

This approach had a huge impact on

the psychology of users and drastically affected their behavior. Looking

at the basic MetaTrader 4 platform used by traders for the last decade or

so, you can easily spot the difference.

A screengrab of the

MetaTrader 4 trading platform. (Photo: MetaTrader 4)

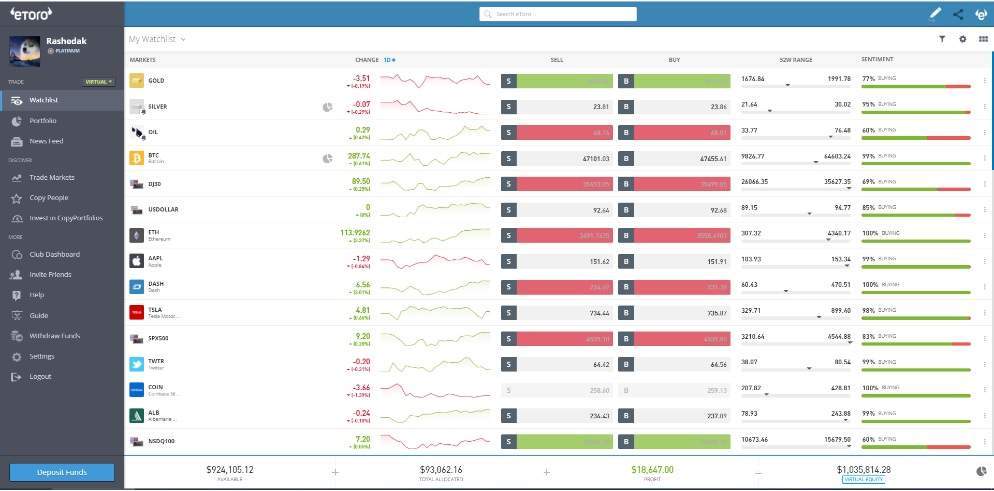

A screengrab of the Etoro trading

platform. (Photo: Etoro)

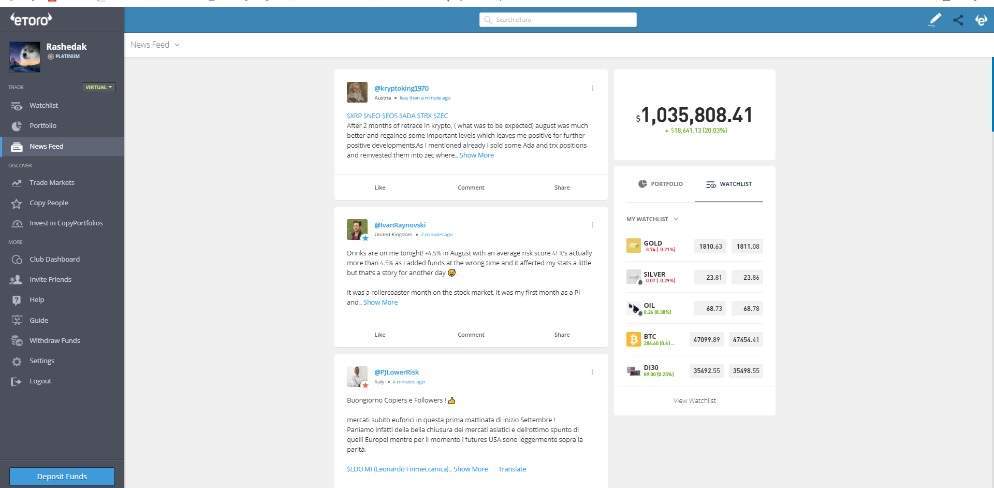

Community features similar to those of social

networks allows Etoro users to share their stats and make comments on each

other's trading activity.

A

screengrab of the Etoro trading platform, showing the platform’s community

features similar to social networks. (Photo: Etoro)

This incentivizes people to trade more and, more

importantly, be tempted by crowd mentality and herd-like behavior which the

broker steers by controlling content on the platform!

This can be incredibly dangerous. You need to

understand that venturing into this type of platform turns investing into a

video game in your pocket, and we all know what eventually happens to overrated apps

on our phones — they end up changing our lives in one way or another, and

usually not for the better.

Read more Business news

(window.globalAmlAds = window.globalAmlAds || []).push('admixer_async_509089081')

(window.globalAmlAds = window.globalAmlAds || []).push('admixer_async_552628228')

This week, the US Securities & Exchange

Commission launched a probe into the digital engagement practices that are used

by brokerage firms. Such practices include the digital advertising,

communications, and user interactions with the brokerage's systems. This probe

also took into account the new phenomena of the gamification of stock trading.

Stock trading and investing in financial markets has

always utilized highly technical and incredibly practical systems. Platforms

like Bloomberg terminal, CapIQ, and others have always had an industrial feel

and look to them with almost no focus on user interface design and user friendliness.

Bankers, traders, and investment advisors also acquired reports in the form of

huge financial statements and large data sets which they would granulate and

organize using tools like MS Excel and SQL. Imagine a stereotypical

trading floor with people sitting in front of a handful of screens with colored

keyboards and strange-looking charts laid out before them; this was the reality

of the trading world.

Today, however, with the growth and popularity of

smartphones and newly emerging sciences such as user experience optimization,

systems are being designed around the user and how apps look and feel is highly

relevant to their layout. You may notice applications are growing more and more

similar in their look and feel, especially in their user experience.

Trading applications like Etoro,

RobinHood, and IQ

Options are probably the ones you hear of most often — it’s very likely you’ve

come across them through a Facebook or YouTube advertisement. These apps were

built for one purpose: To disrupt the digital trading world through gamifying

the user experience by adding colors and

unique designs to each stock and providing notifications and alerts in a way

people are used to with their social media.

This approach had a huge impact on

the psychology of users and drastically affected their behavior. Looking

at the basic MetaTrader 4 platform used by traders for the last decade or

so, you can easily spot the difference.

A screengrab of the

MetaTrader 4 trading platform. (Photo: MetaTrader 4)

A screengrab of the

MetaTrader 4 trading platform. (Photo: MetaTrader 4)

A screengrab of the Etoro trading

platform. (Photo: Etoro)

A screengrab of the Etoro trading

platform. (Photo: Etoro)

Community features similar to those of social

networks allows Etoro users to share their stats and make comments on each

other's trading activity.

A

screengrab of the Etoro trading platform, showing the platform’s community

features similar to social networks. (Photo: Etoro)

A

screengrab of the Etoro trading platform, showing the platform’s community

features similar to social networks. (Photo: Etoro)

This incentivizes people to trade more and, more

importantly, be tempted by crowd mentality and herd-like behavior which the

broker steers by controlling content on the platform!

This can be incredibly dangerous. You need to

understand that venturing into this type of platform turns investing into a

video game in your pocket, and we all know what eventually happens to overrated apps

on our phones — they end up changing our lives in one way or another, and

usually not for the better.

Read more Business news